Public Sector

My experience of working with Roadnight Taylor’s Connectologists® was exceptional

"My experience of working with Roadnight Taylor’s Connectologists® was exceptional.” Read more of what Ingrid Hooley of Local Partnerships had to say...

Current± outlines the importance of our Open Letter to Ofgem

Current has outlined the content of our letter to Jonathan Brearley, OFGEM CEO, and explores the three options our Connectologist® Pete Aston proposes to solve the current issues with SGT charging

Connectologists® featuring in ‘Grid Locked’ article in The Times’ Raconteur report: “Energy & Sustainability”

We are excited that two of our Connectologists® have featured in the Times’ Raconteur article that has been published as part of a special report: “Energy & Sustainability.”

Utility Week interviews Roadnight Taylor to discuss the contents of our open letter to Ofgem

Following our Open letter to Ofgem urging them to consider reforming the mechanism for supergrid transformer charging, Utility Week got in contact to discuss the letter's contents and our suggestions for reform.

Financial Times reaches out to Roadnight Taylor for insight into how the grid capacity issue is stunting UK economic growth

Financial Times reaches out to Roadnight Taylor for insight into how the grid capacity issue is stunting UK economic growth

BloombergNEF’s report on grid connection queues supported by Roadnight Taylor’s perspective and data

BloombergNEF’s report on grid connection queues supported by Roadnight Taylor’s perspective and data

KPMG seeks insight from Roadnight Taylor for their report on Smarter Grids

We were delighted to have been asked by KPMG as‘UK electricity experts’ to give insight and pre-publication feedback on the UK content of their ‘Smarter Grids: Powering decarbonisation through technology investment’

Financial Times approaches Roadnight Taylor for deeper understanding of grid connection delays

Our CEO Hugh Taylor has been quoted in an article in the Financial Times that explores the delays in connecting to the grid that are threatening Britain’s net zero targets.

How to choose the right grid consultant

With the renewable energy, energy storage, commercial and industrial and datacentre industries now awash with developers and investors, how can those looking to originate or acquire schemes be confident that they are making the right decisions and investing their time and money – and their valuable opportunities – in the right company or consultant?

Current± invites our Connectologists® to give their perspective on the grid connectivity issue

Pete Aston has been interviewed and quoted by Current± on grid connectivity - one of the core challenges plaguing the UK’s energy networks.

Pete Aston gives his insight on grid connection delays to E&T

E&T interviewed Pete Aston, along with developers and engineering firms, on how grid connection delays are putting both climate targets and energy security at risk.

The NSIP threshold change from 50MW DC to AC, and solar farm design considerations

The September 2021 updated Draft National Policy Statement for Renewable Energy Infrastructure (EN-3) has implications on project sizes. We found out more about this and the latest in large-scale solar design.

Green hydrogen – what role can it play in solving grid issues, and more…

With the potential to unlock additional revenue for renewables projects, green hydrogen can be an avenue for developers to explore. Hugh Taylor spoke to Will Turner at Octopus Hydrogen to find out more.

Flexible connections and flexibility services

Hugh Taylor spoke to Chris Collins of Baringa to start a series of blogs looking at flexible connections and flexibility services.

Nikki Pillinger joins Roadnight Taylor as our fourth Connectologist®

Find out more about Nikki Pillinger, former grid connections manager at British Solar Renewables and GRIDSERVE, and her reasons why she joined Roadnight Taylor. Our CEO, Hugh Taylor, also explains why Nikki is a perfect fit for the Roadnight Taylor team.

Managing land rights consents in the changing grid connections landscape

Hugh Taylor spoke to Laura Wilson, Director at Connections Legal Management (CLM), about how the rapidly changing grid connections industry is impacting on the demand for land rights legal management and the specialist services that developers are seeking.

Pete Aston joins Roadnight Taylor as Network Engineer

Find out more about Pete Aston, former Primary System Design Manager at Western Power Distribution, and his reasons why he joined Roadnight Taylor. Our CEO, Hugh Taylor, also explains why Pete is a perfect fit for the Roadnight Taylor team.

Don’t take a risk with energy agreements

Landowners must think twice before signing renewable energy agreements as they could end up tied into astronomical bills and unsuccessful projects, or be unable to successfully negotiate rents and lease terms.

Our 2020 results

We thought our achievements in 2019 were phenomenal, but 2020 was our true breakthrough year. We secured over two gigawatts-worth of capacity for solar for clients, saved our developer clients many £millions in connection offer non-contestable costs and more...

Overcoming grid capacity issues – Solar and Storage Live 2020

Hugh was invited to take part in a panel discussion at the virtual Solar and Storage Live event in December 2020. You can watch the recording here. The panel discussed the barriers and opportunities for addressing grid capacity, and how we can get the most from existing grid infrastructure to deliver Net Zero efficiently.

Exclusivity agreements for energy schemes: pitfalls and opportunities

In seeking to achieve a solar, wind or energy storage scheme, one of the first steps a developer will take is to secure an exclusivity agreement with the landowner. We take a closer look at exclusivity agreements, speaking to the expert team at Renew Legal, to understand what they are, the issues that can arise from them and if there are alternative approaches.

Deadline looms to reduce Climate Change Levy

Businesses have only a few months left to benefit from reduced energy bills through the extended Climate Change Agreement (CCA) scheme. Richard Palmer explained to The Energyst why even smaller business should think about joining the CCA scheme

Roadnight Taylor appointed as a Crown Commercial Service supplier

We’re pleased to announce our appointment onto Crown Commercial Service’s Heat Networks and Electricity Generation Assets (HELGA) agreement.

Q&A: Why business rates shouldn’t scare people away from solar – Solar Power Portal

After the Lidl's case highlighted business rates on solar, Richard was interviewed by Solar Power Portal to find out what needs to change to make business rates and solar work.

Non-domestic solar arrays underperforming by £millions annually

Many commercial/non-domestic solar photovoltaic (PV) schemes are financially underperforming and reduced energy output isn’t the only cause, our recent PV HealthChecks have found.

Energy Opportunity – RICS Land Journal

Hugh was invited to write for the RICS Land Journal. He covers the energy scheme opportunities for landowners, the different approaches, the current issues and technology options, and how to maximise chances of success.

Don’t let Lidl business rates liability case scare you away from solar

The recent news that supermarket chain Lidl saw its business rates jump by over 528% due to changes in the valuation of the solar PV installations at its sites, should not scare businesses away from solar.

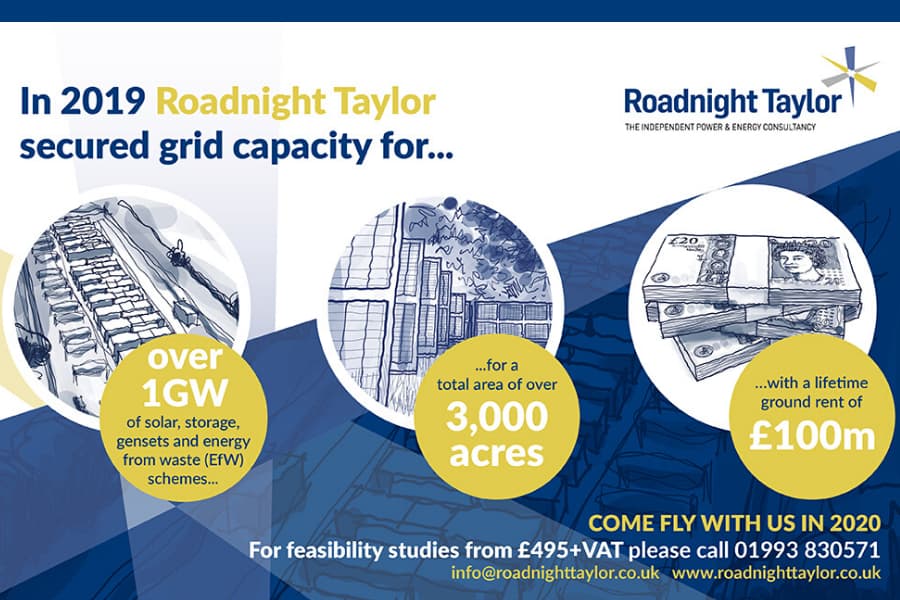

Our 2019 results

In 2019 we secured grid capacity for over 1GW of solar, storage, gensets and energy from waste (EfW) schemes, on over 3,000 acres with a lifetime ground rent of £100m. Why not join us in 2020?

Smart Export Guarantee – Part 2: What to do now if investing in renewables

The days of stacking lots of solar panels on a roof to benefit from the FiT are over. A change in mindset is needed when considering investment in renewables. Richard Palmer looks at how you can make sure you invest wisely.

Smart Export Guarantee – Part 1: Not so smart or much of a guarantee!

Our Senior Consultant, Richard Palmer, looks at the new Smart Export Guarantee and explains, how as financial returns are no longer guaranteed, it forces a mindset switch for those looking to invest in renewable energy schemes.

5 Must-Dos before making an investment in on-site solar PV

We are increasingly being asked by clients to assess quotations from renewable energy installers. We've found several common issues with our clients’ approaches and, more worryingly, with the contractors they are employing to install schemes.

Renewables projects – a series of articles with Ashfords Energy & Waste Team

A series of articles written by Ashfords Energy & Waste Team and Roadnight Taylor's Richard Palmer assessing the opportunities and challenges for owners of renewable energy assets or for those looking to invest in a scheme.

The return of the large-scale standalone solar market

As solar technology prices decrease and energy prices increase, we are at a tipping point in the large-scale solar market. With opportunities returning, large-scale solar, located with or without batteries, can offer landowners with the right sites a strong diversification income.

13 Do’s and Don’ts for securing lucrative ground rents from energy schemes

There are opportunities for landowners to earn diversification incomes from power generation and energy storage schemes. We give some tips to ensure you secure the best ground rents from hosting such schemes.

Battery storage versus gas gensets – a market snapshot

We are currently seeing a stronger market and appetite from developers for gas genset sites compared to battery storage sites. This results from several related market conditions which we explain below.

Don’t miss National Grid’s deadline

Press release: Time is running out for landowners who want to host a large-scale power generation or battery storage scheme, with a key deadline looming.

How assessment and design fees became connection offer expenses

Hugh was invited to contribute a feature article to Utility Week. Given the impending Connection Offer Expenses that Distribution DNOs can charge from 6 April 2018, he surveyed his contacts at the DNOs to get an idea of their charging intentions.

Act quickly to avoid grid application fees

Press release: Farmers and landowners interested in energy generation or storage projects should act quickly to avoid potentially steep fees. From 6 April network operators in England, Wales and Scotland will be able to charge up-front fees for grid connection offers, which could run into thousands of pounds.

Tread carefully with grid advice before paying for an application

Many landowners have contacted us recently after they've been approached by firms touting grid advice and persuading landowners to sign up to up-front fees for making a battery storage grid application. Read how you should beware of this approach and find out how we are different.

A sad day caused by grid connection application scandal

A sad day caused by grid connection application scandal This article was first published on Linkedin on 30 November 2017 and was picked up and republished by The Energyst. I rang to say goodbye and good luck to a brilliant System Planner (an extra-high voltage network designer) who is leaving one of our favourite Distribution Network Operators yesterday. It was upsetting to hear he is leaving because of the huge volumes of grid applications he receives that don’t proceed. He believes that out of every 100 applications he processes, only five grid offers are accepted and only two offers see [...]

Will we see standalone subsidy-free solar in 2018?

2017 saw the first subsidy-free solar farm energise, but the scheme was located with battery storage and had an existing suitable grid connection. The burning question is when could we see a subsidy-free standalone scheme deployed on a new connection?

Behind-the-meter battery storage: the pitfalls to avoid

Behind-the-meter battery storage remains an expensive technology, and the risks of investing unwisely are high if you haven’t done your research and correct planning first. Battery storage is not suited to all sites, not all sites will a business case for scheme and the risks of being mis-sold are high.

Should you be tapping into battery storage opportunities behind the meter?

Battery storage located ‘behind the meter’ is an emerging market which holds huge potential for energy cost savings and income opportunities for some businesses, farms and estates. We look at what it is, which sites it is suited to and highlight the benefits it can bring to a site.

‘Grid is King’ for any stand-alone or co-located scheme

We are delighted that our CEO, Hugh Taylor, has been interviewed for The Energyst. Grid is King for any standalone or behind-the-meter, single technology or co-located schemes.

Subsidy-free stand-alone solar is coming, but it isn’t quite here yet

At the end of September the UK's first subsidy-free solar farm was unveiled. There is no doubt that this scheme is a step forward for the renewables industry. However, even though this scheme was financially viable without any subsidies, it doesn’t mean that every large solar scheme will be, in the short term.

What makes a good gas genset site?

Most of the 'noise' in the energy industry is about the lucrative opportunities from battery storage, and we've written about sites that are suitable for battery storage before. However, batteries are not suitable for all sites or all parts of the electrical grid. A gas genset may be suitable for sites where a battery storage isn't.

Find out if you have viable battery storage or power scheme sites

Any battery storage or power generation scheme will need a cost-effective grid connection. It may also need planning consents, land rights, the right generation or demand profile, sufficient budget and an appropriate return on investment.

How to choose the right grid consultant

With the power generation and energy storage industry awash with developers and consultants, how can landowners looking to invest in energy schemes be confident that they are making the right decision and investing their time and money in the right company or consultant?

Do you have a site suitable for battery storage?

Numerous factors must conspire for a site to be viable for battery storage. See how you should find out if you have genuine potential for a site in this article first published in Energy Now magazine.

Woah! Hold your horses on battery storage!

Hugh urges those spouting forth the huge opportunities from battery storage to approach storage much more cautiously. He looks at the pitfalls and correct approaches to leasing sites to storage developers and self-funded schemes.